How the City Gets Money

Most of the City’s revenue comes from residential and commercial property taxes. We collect additional revenue from:

- operating revenue, which includes building permits and user fees like fitness memberships, pet licenses, etc.; and,

- other revenue, which includes grants and funding from other levels of government (e.g. Canada Community-Building Fund), etc.

In addition to these sources, we are continuously exploring other ways to generate revenue to offset operating costs.

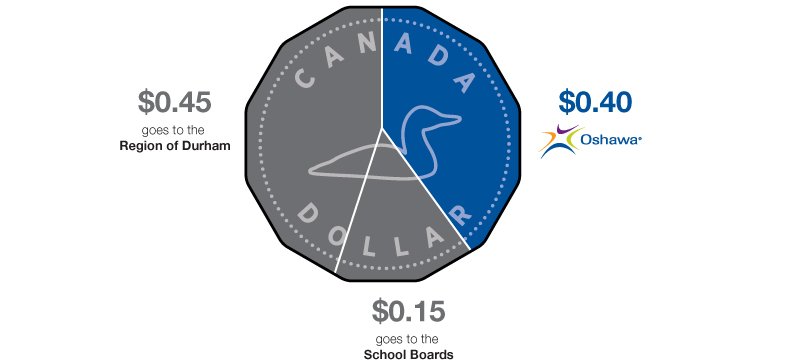

How property taxes are divided

As a lower-tier local government, the City of Oshawa collects property taxes for not only the City, but also on behalf of the Region of Durham, and for the Province of Ontario for local school boards.

The City’s 2024 Budget included a 3.89 per cent budget increase; this means that residents will see a 2.84 per cent increase in the City portion of the Residential Property Tax Bill.

Review an estimated breakdown of your property taxes on our Property Tax Calculator.

For every dollar collected in 2024 for residential property taxes, the City kept only 40 cents, while appropriately 45 cents were allocated to the Region of Durham and 15 cents were sent to the Province.

Learn more about Property Taxes on the Property Taxes webpage.

Learn more about the roles and responsibilities of different levels of government.

Learn more about the Region of Durham’s budget on its Budget and Financial webpage.

Contact us

Finance Services

Oshawa City Hall

50 Centre St. S.

Oshawa, ON L1H 3Z7

Phone: 905-436-3311

Toll Free: 1-800-667-4292

Email: Finance Services

Get information from the source

Subscribe to City News and get the latest updates delivered to your inbox.