Incentives and Programs

Companies located in Oshawa enjoy the benefits of doing business in Ontario, Canada. In addition to having a stable financial system, Canada's overall marginal effective tax rate is the lowest in the G7 and Canada offers the lowest business costs in G7 for research and development intensive sectors (KPMG Competitive Alternatives Study, 2014).

Local Incentives

The City of Oshawa has a rich history of involvement in efforts to improve the community. These community improvement incentives, approved by the Province of Ontario, are just another way that Oshawa works with private sector partners to re-invest in our great city.

Business Funding and Support Finder

Oshawa Economic Development has partnered with Fundica to provide businesses with an easy way to find government funding in Canada. Through its proprietary search tool and intelligent filtering, Fundica helps entrepreneurs and businesses find grants, tax credits and incentives, loans, loan guarantees, equity and accelerators. Access this Business Funding and Support Finder to discover a growing list of resources aimed to address your business needs.

Community Improvement Plans

Community Improvement Plans (also known as C.I.P.’s) are financial incentive programs that are designed to encourage development and redevelopment in designated areas throughout the City of Oshawa. Property and/or business owners can apply for financial support in improving the visual and functional aspects of their commercial, industrial, and mixed-use residential buildings or parcels of land.

Visit our Community Improvement Plans webpage to learn more about the C.I.P. and Graffiti and Vandalism Remediation Fund grant programs available within the City of Oshawa.

Downtown Development Charges

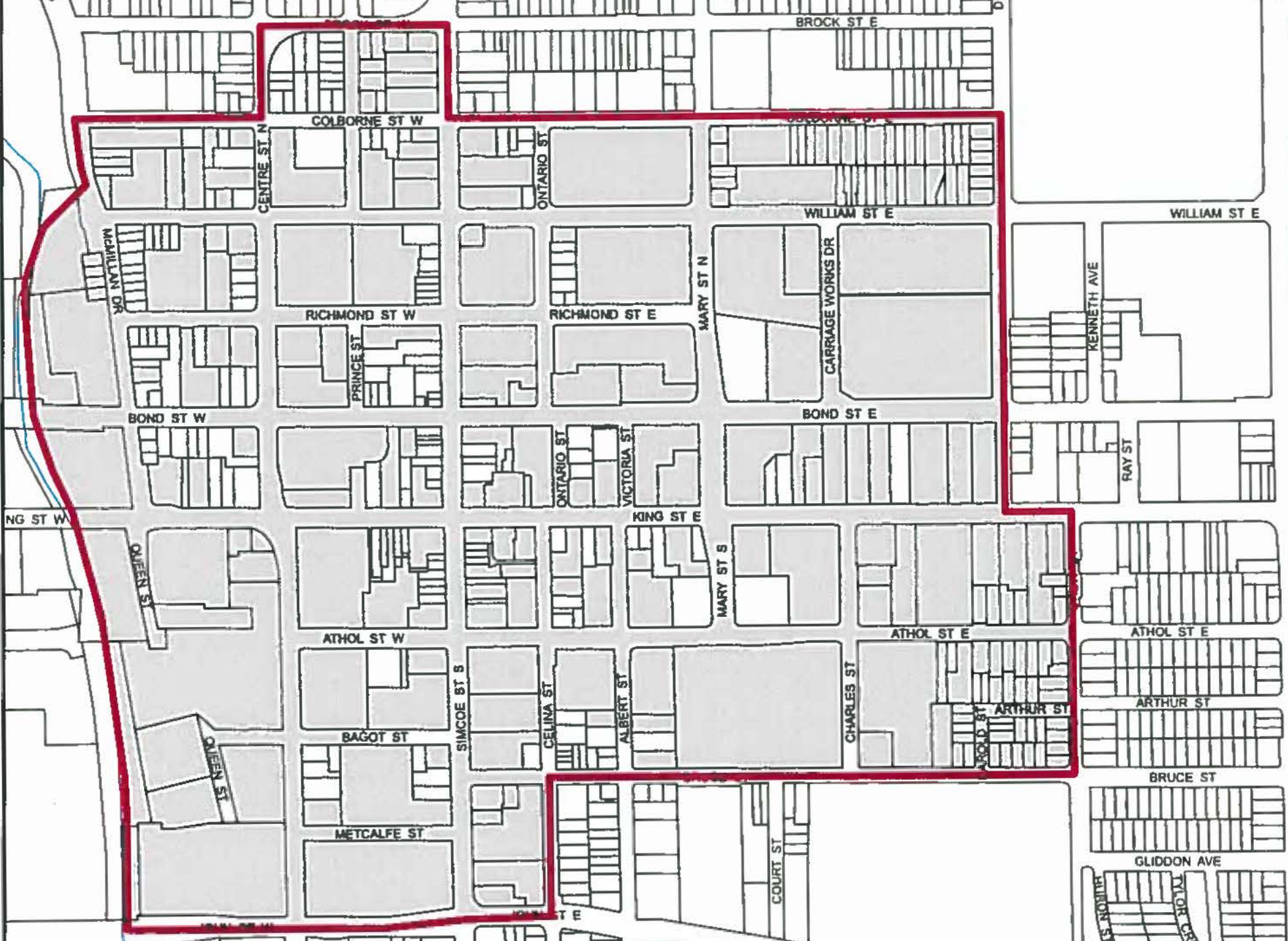

No Development Charges shall be imposed with respect to any Development (Development Charges By-law Section 3.6): On lands wholly within that part of Oshawa partially known as the Core Area of the Downtown Oshawa Urban Growth Centre and as depicted in Schedule “D” to this By-law:

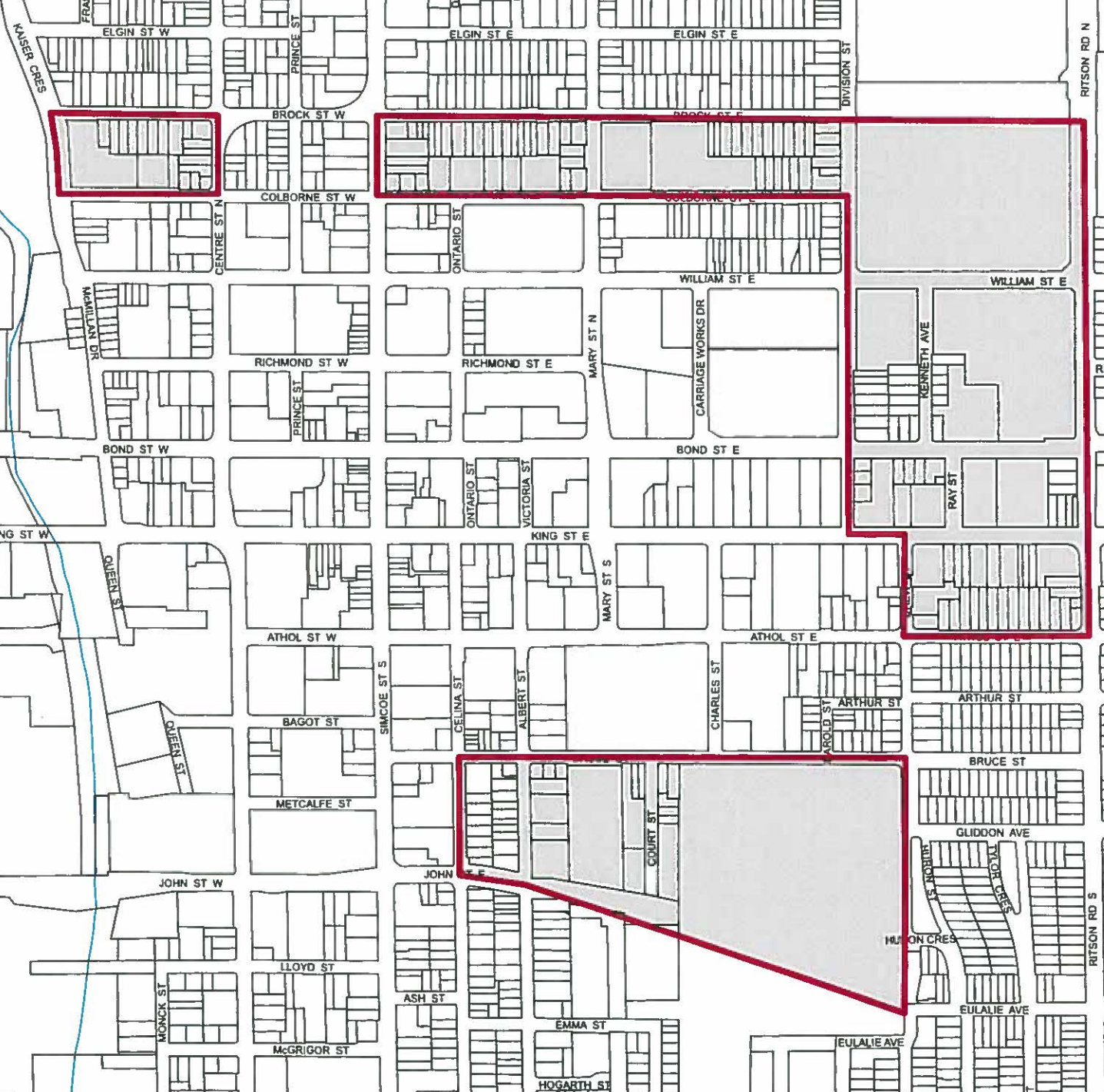

Respecting an Apartment Dwelling Unit or a Townhouse Dwelling Unit, except back-to-back Townhouses, on lands within that part of the Shoulder Area of the Downtown Oshawa Urban Growth Centre as shown as the shaded portion of the map in Schedule “F” to this By-law:

Industrial Development Charges

No Development Charges shall be imposed with respect to any Development (Development Charges By-law Section 3.6): respecting a new Industrial building or structure or the enlargement of an existing Industrial building or structure.

For more information, please visit our City of Oshawa Development Charges page or contact Building Services via [email protected] or 905-436-3311 ext. 2290.

Provincial and Federal Incentives

There are several Provincial Incentives and Federal Incentives available in commercialization, exporting, human resources and research and development.