Budget

The City’s budget is aligned with the goals of the Oshawa Strategic Plan, Financial Strategy and Council’s guiding principles of sustainability and financial stewardship, and provides a foundation to:

- meet the public service needs of our residents; and,

- make decisions on City infrastructure.

This page also includes the 2026 Budget Engagement and new 2025 Budget communications, Budget Highlights and the Budget 101 video series.

2026 Budget

The City invited residents and property owners to share their budget priorities and learn more about how their taxes are used in its Budget Simulator.

Share your budget priorities

This budget engagement opportunity has now closed.

Community members could share what services and programs were important to them by adjusting funding and service levels in our Budget Simulator. Just like the City’s budget, the simulations had to be balanced in order to be submitted! Priorities could be shared online or on paper at Service Oshawa (located at City Hall, 50 Centre St. S.) and were accepted until 12 p.m. Monday, June 9.

All individual responses are anonymous and only used to summarize overall feedback received from the public. Feedback will be shared with members of Council and considered in the development of the 2026 Mayor’s Budget.

Budget process

The 2026 City Budget will be delivered to Council and made available online for public review on Friday, October 31. Members of the public are welcome to watch the meeting online via webstream or in person in the Council Chamber beginning at 9:30 a.m.

A Special Meeting of Council will be held at 9:30 a.m., Friday, November 14 to hear public delegations on the 2026 City Budget. To submit correspondence, it must be submitted to Legislative Services by 4 p.m. on the business day prior to the meeting. Requests to delegate electronically must be submitted by noon on the business day prior to the meeting.

2025 Budget

The 2025 Budget was adopted in December 2024 and is available for public review on the Budget Documents webpage.

The City adopted a tax rate of 7.87% and the Region has posted a tax rate of 7.40% on their website. The Oshawa portion of the total tax bill requires an increase of approximately $168.86 for the year on an average assessed property value as determined by M.P.A.C.

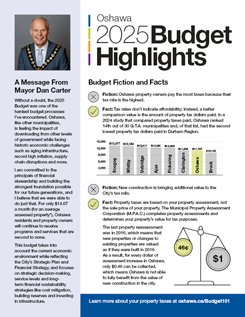

To make it easier to understand how the Budget works, the City is launching two new budget communication tools: Budget Highlights and the Budget 101 video series. These resources are designed to make budget information more clear, accessible and easier to follow for all.

Budget Highlights

Looking to better understand the 2025 City Budget?

Check out Budget Highlights, the City’s new four-page guide that breaks down key priorities, clears up common myths, and helps you see where your property taxes were invested.

Budget 101 Video Series

Take a walk through City facilities with Stephanie Sinnott, the City’s Commissioner of Corporate and Finance Services and City Treasurer, as she breaks down budget essentials and shines a light on elements of municipal budgeting.

Watch the Budget 101 Playlist on the City's YouTube Channel!

Tax Rates versus Taxes Paid

Take a walk through City Hall with Stephanie as she explains why tax rates are not a reliable factor to compare taxes.

Operating Budget

Go behind the scenes at the City's Consolidated Operations Depot with Stephanie as she breaks down the Operating Budget.

Capital Budget

See another side of City Hall as Stephanie breaks down the Capital Budget.